31 Ways To Save Money On Groceries

About seven months ago I really took a look at how much I was spending on food each month and it bitchslapped me into reality. I decided to take control of my spending and stop being such a jackass with money. I did a complete re-haul of my food spending and it has made a helluva difference. I went from spending an average of $1600/month to now spending an average of $600/month. That’s a difference of $1000 a month! Like seriously, SAY WHAT?! That’s a lot of dollahs!

Wanna know exactly how I did it? Here we go!

Ways To Save Money On Food At Home

1 Set a Grocery Budget

Okay, so let’s start with a no-brainer. You gotta set a grocery budget!

You’re gonna be surprised at how much you’ve been spending on food. Go ahead and add it up. Add up all of the restaurant bills, fancy coffees, and all the extras you chuck into your grocery cart every week. The number will floor you. It’s time to take control of the money you work so hard for and stop wasting it on the wrong food. You can still have full cupboards and save money at the same time.

So how do you set a grocery budget? Well everybody’s budget is a little different and of course depends on the size and needs of your family, but a good place to start is to spend $25-$40 per person per week, again, depending on your family’s needs. It’s a good idea to start at $40 per person so that you can easily succeed at your initial budget goals. Once you have a couple of successful weeks under your grocery belt, you can work on lowering the grocery allotment per person.

Another way to set a budget is to dedicate 10% of your weekly net income for food. This should include ALL food: groceries, restaurant bills, and take out. You can feel it out for a few months and try both budget plans to see which one you like better. You will end up finding your budget sweet spot and be absolutely shocked at how much money you save.

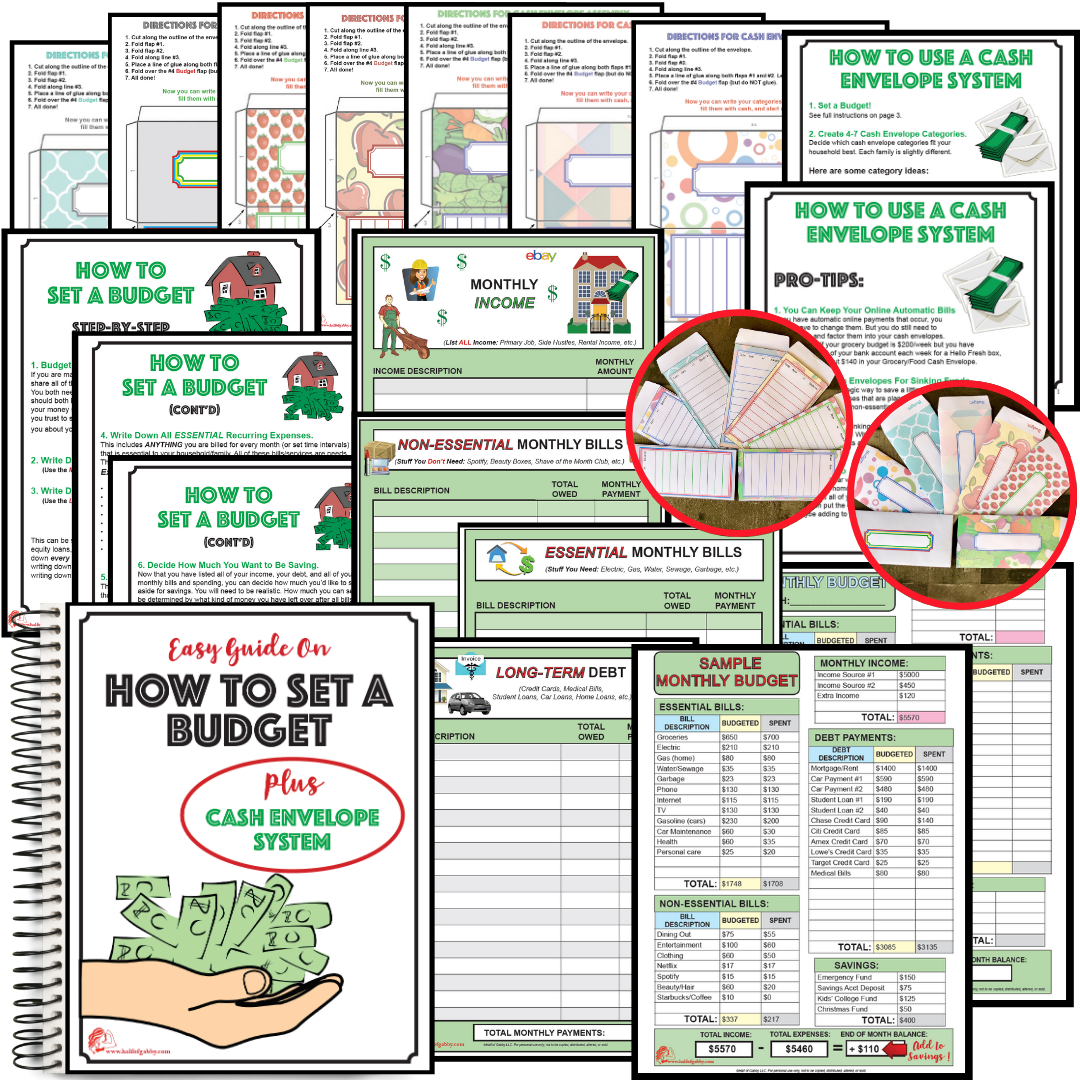

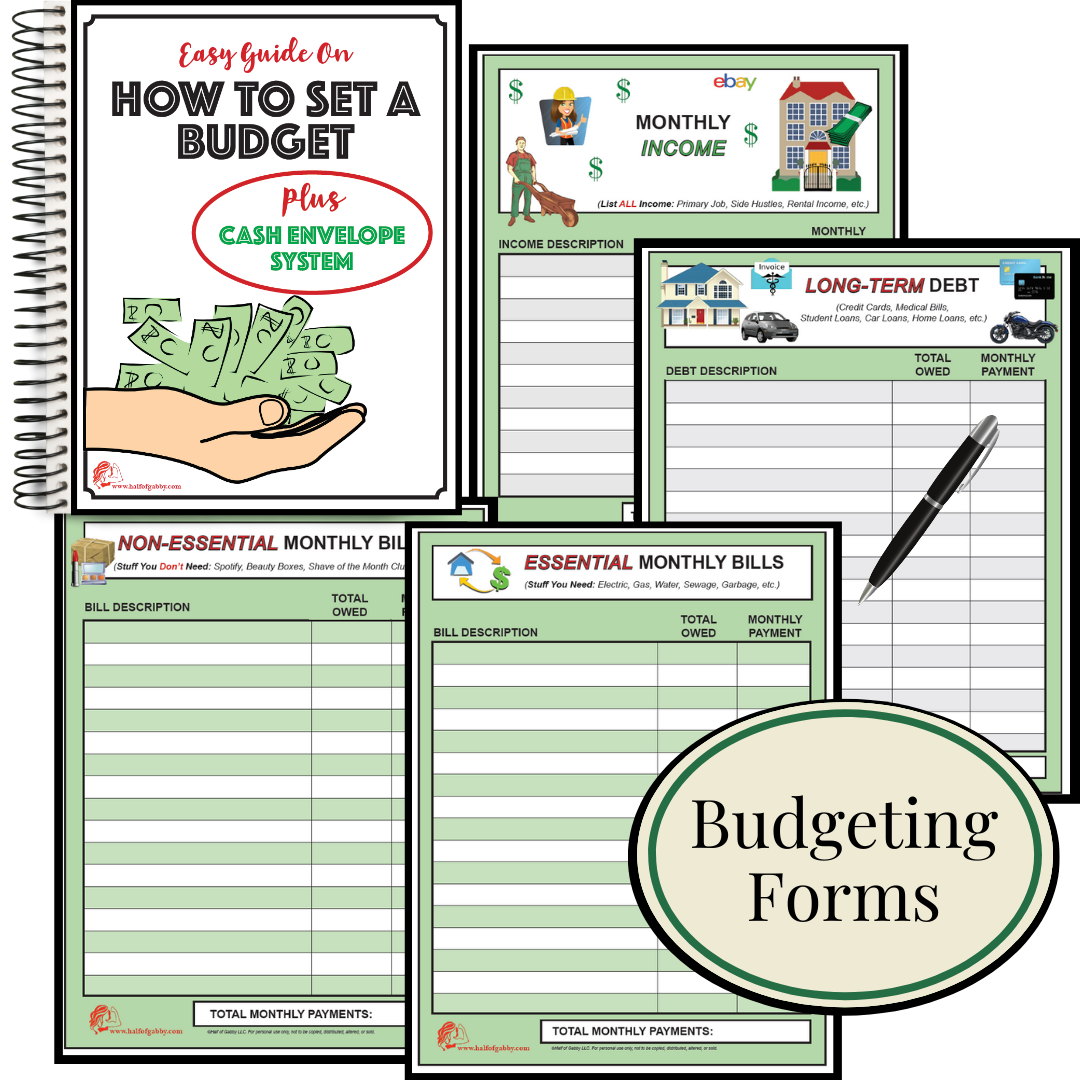

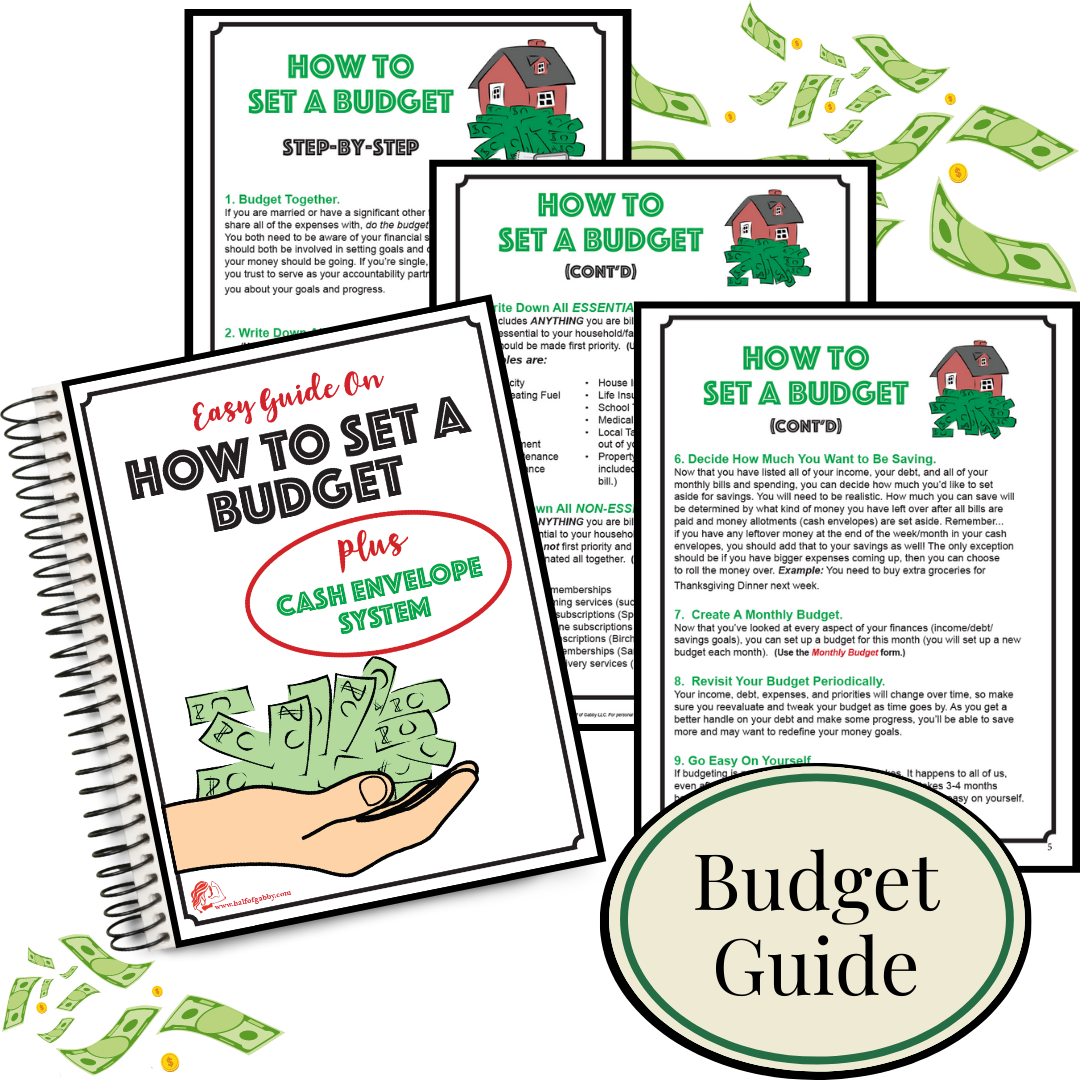

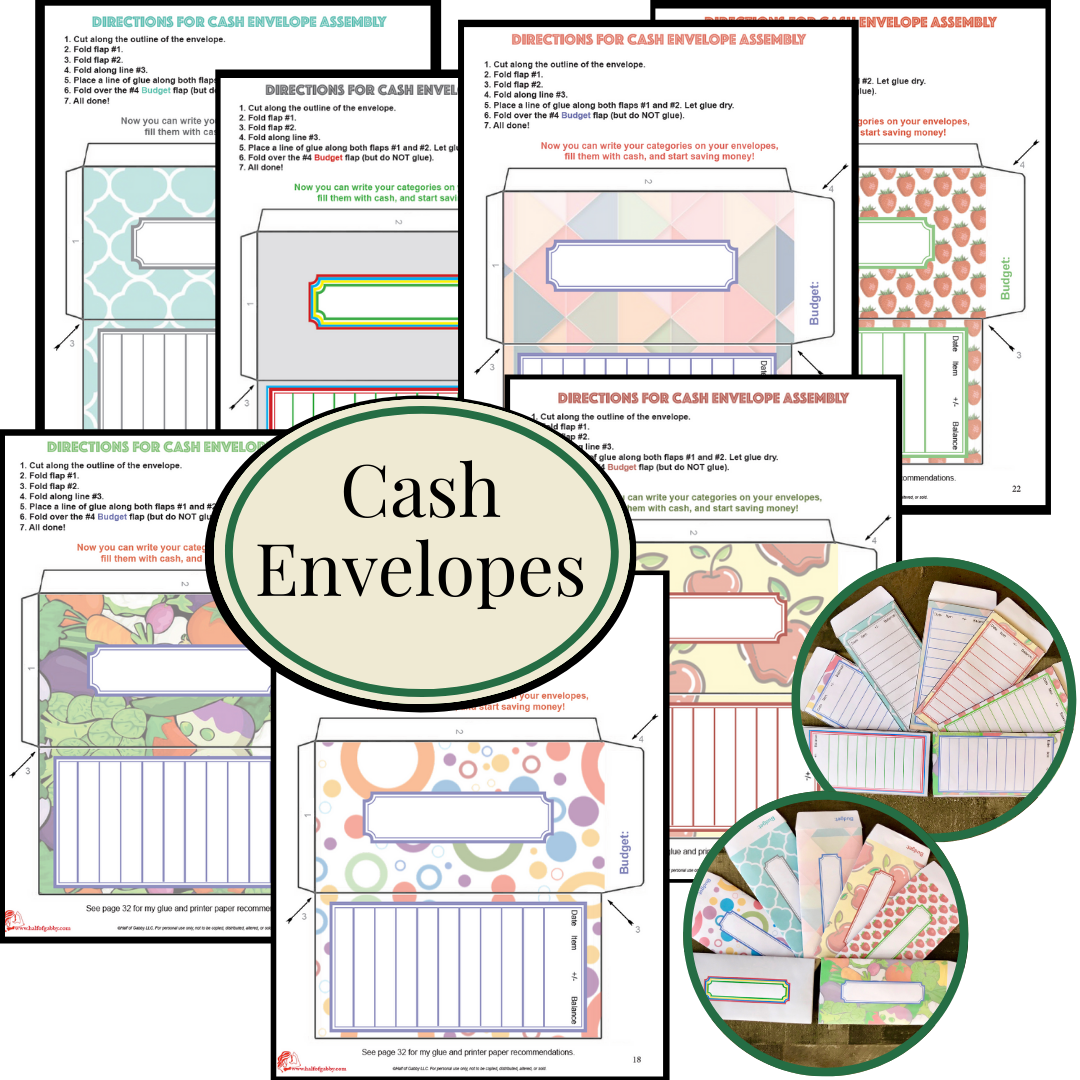

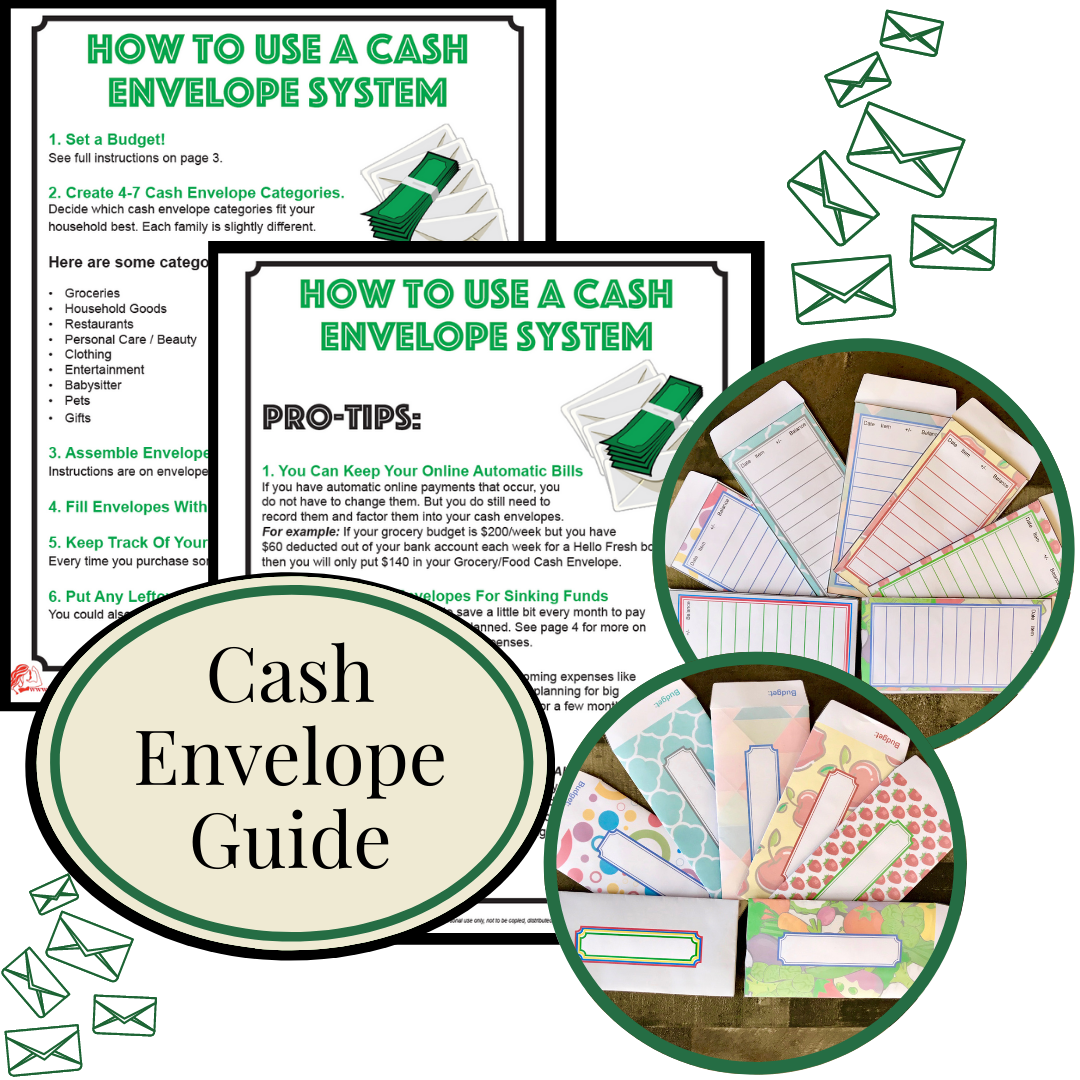

PRO-TIP: Use the Cash System using Cash Envelopes. When we pay with credit cards or debit cards, we tend to spend more. The notion of money when using plastic gets lost since we never actually see it. When you set your grocery budget aside in cold hard cash, you are MUCH more mindful and smarter about how you spend it.

Check out my 38-page Cash Envelope & Budget Kit! YOU GET ALL 7 DESIGNS!

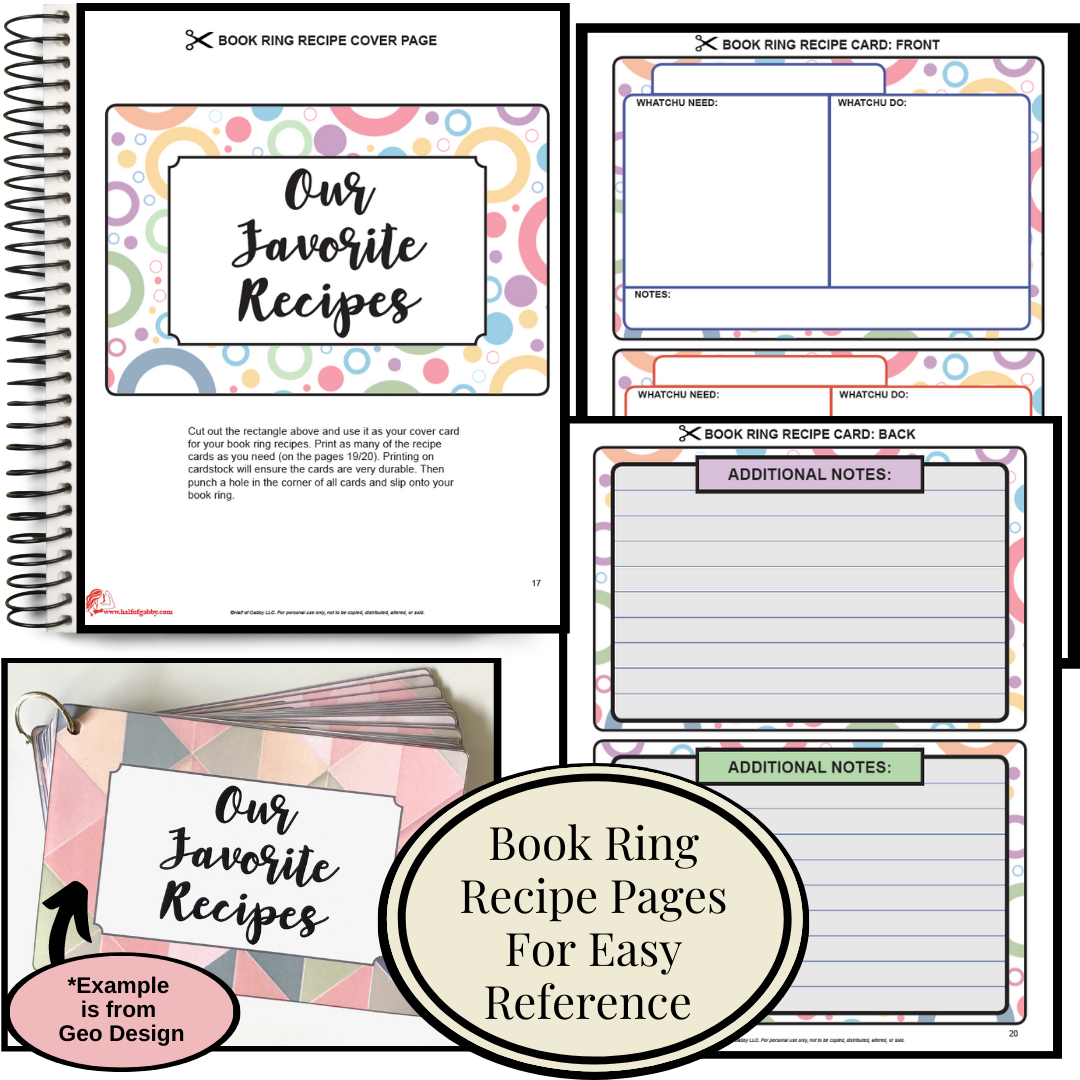

2 Plan Your Dinners

I am focusing on dinners here because dinner is the biggest pain in the ass meal of the day. I say that because everyone else in the house typically eats the same dinner as you. You of course should plan ahead for breakfasts and lunches too but most often you’re fending for yourself with those and if you’re anything like me, you’re not picky and will settle for whatever is in the house for your first two meals. Dinner is a whole different scenario because you have hungry scavengers looking to you to feed them. God, why do they need to eat everyday?

Take about 10-15 minutes once a week and actually sit down and plan out the dinners for the week ahead. Write it down! I go as far as hanging up a Weekly Dinner Menu, because it saves me incessant hounding from hungry mouths who want to know what’s for dinner.

PRO-TIP: Hang up a Weekly Dinner Menu for all to see. This will save you from being repeatedly interrogated by curious hungry creatures. It’ll also serve as a visual reminder for you and help you to remember any night-before prep you may need to do for the next day’s dinner.

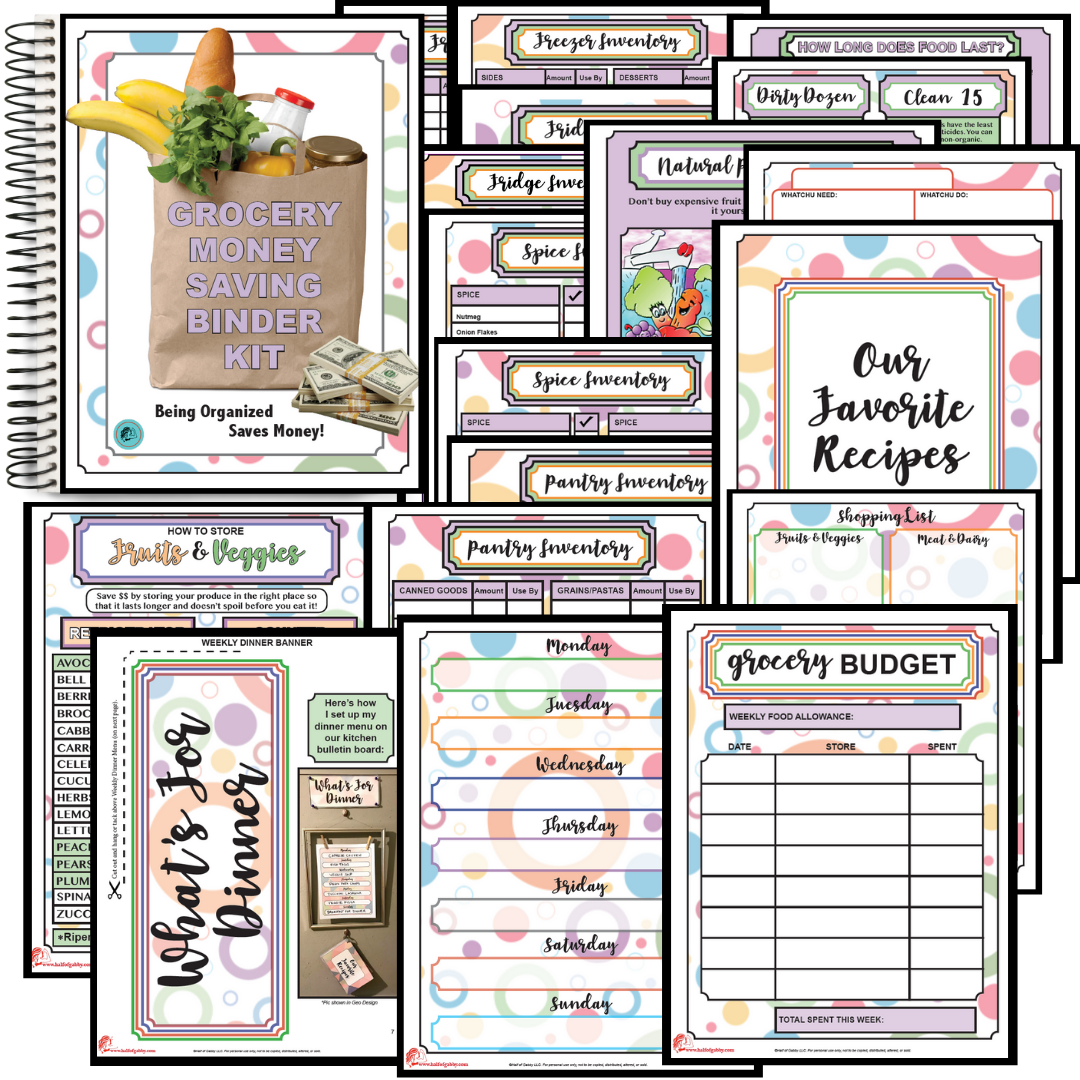

A printable Weekly Dinner Menu is included in my 39-page Grocery Budget Binder Kit, which comes in 7 different designs! The designs match the Cash Envelopes! Pick your favorite one and start saving money! Here’s a peek at 4 of the designs:

PRO-TIP: Check out your local grocery ads when you’re planning dinners for the week. Decide on dinners that work well with the current sales. If chicken breasts happen to be on sale, maybe plan for chicken quesadillas or chicken noodle soup. Sometimes it’s easier to let the sales ad determine your dinner plan instead of racking your brain over what to make.

PRO-TIP: Also think about adding in a meatless dinner night (Meatless Monday is a popular dinner night idea). This ends up being a twofer. One because meat is the most expensive item on your grocery list and two because eating more plant-based meals can up your health game.

If you don’t plan your dinners, you’ll find yourself calling for take out or hitting a drive-thru for dinner a lot more often. Even if you don’t resort to fast food or restaurant takeout and you’re cooking all your dinners at home, you’ll find yourself hitting the grocery store multiple times each week in order to drop in and pick up your ingredients for your last minute dinner ideas. Aaaaand if you keep going to the grocery store all week, you are bound to buy shit you don’t need and isn’t on your list… which brings us to my next tip.

3 Make a List and Stick To It!

If any of you have a failing brain like me, you already do make a list. If I don’t make a list, I end up coming home with nothing that I actually need. I am completely lost without a list. The harder part is to actually stick to the list! Resist the temptation to let your eyes wander. Buy what you need and ONLY what you need. The cost adds up quickly if you’re mindlessly throwing shit in your cart.

PRO-TIP: Make your list on your phone so that there’s little chance you’ll leave it at home. It’s extremely easy to forget a piece of paper on your kitchen counter, but we usually always make sure we have our phones with us before we leave the house.

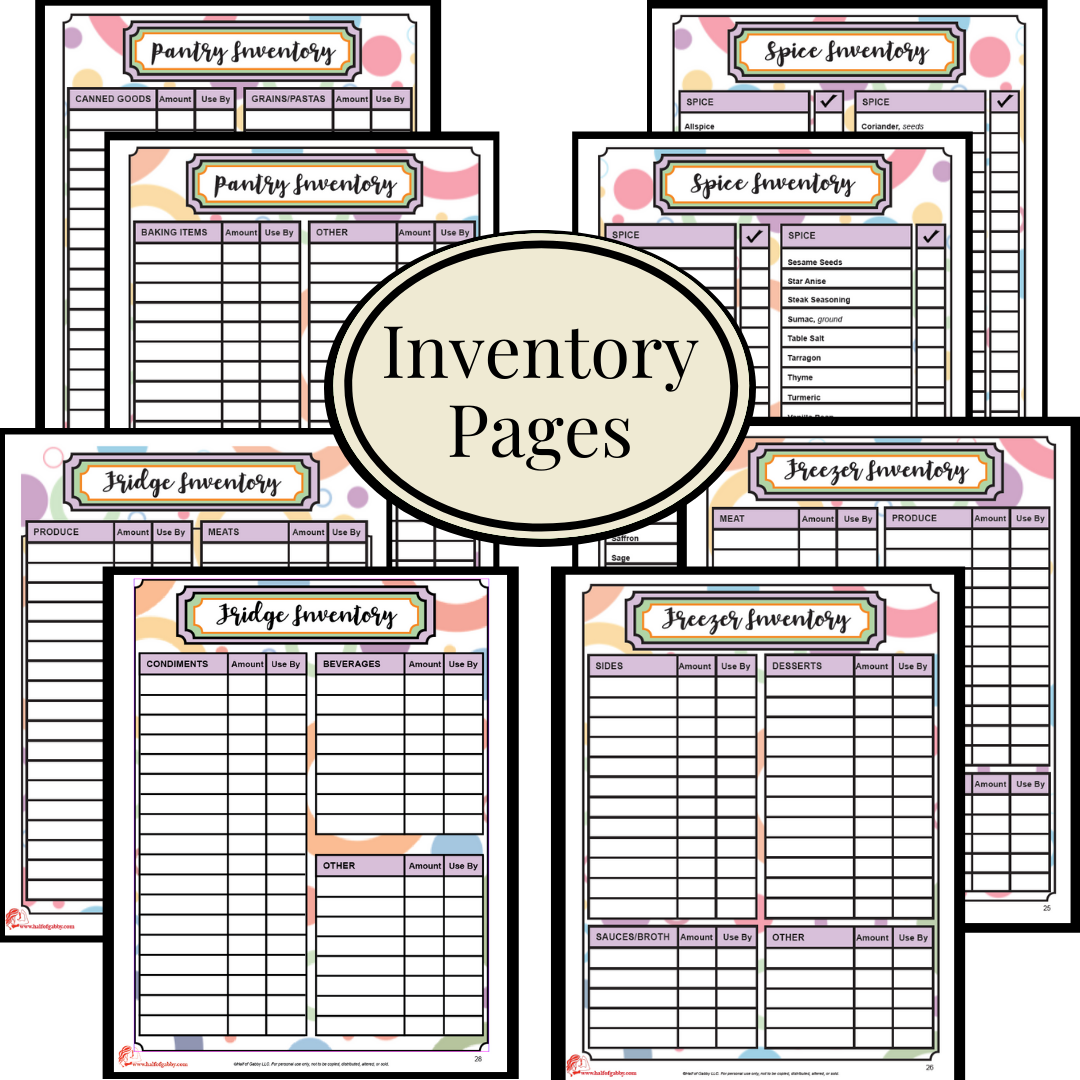

4 Stay Organized

Nothing will save you more money than being organized! Knowing ahead of time what meals you’ll be making and knowing exactly what foods you already have in the house will make a HUGE difference in your spending. Keeping an inventory of what you have will prevent you from double buying. It will also keep your visits to the grocery store to a minimum. How many times have you not bought a certain spice or ingredient at the store because you thought you had it at home already when really you didn’t? It totally sucks to be ready to make a recipe and as you’re looking through your cabinets, you realize you’re out of a key ingredient. Keeping all of your information in one place helps you stay on track and is hella good for the wallet.

PRO-TIP: Keep a Grocery Binder where you can keep all of your vital grocery and kitchen info. It helps tremendously in not only saving you a ton of money each and every week, but it keeps you sane!

Check out my 39-page Grocery Budget Binder Kit! IT COMES IN 7 DESIGNS!

5 Shop From Your Kitchen

Once you have taken inventory of everything that you have, you can start using it all up! How many times do you forget about what’s buried in your freezer or hiding in the back of your pantry? By the time you dig that stuff out, it’s expired and you have to throw it away. Take the next few weeks and plan your dinners and other meals around what you already have. Not only will you save a crap ton of money at the grocery store for the next couple of weeks, but you’ll be saving yourself money in the future too by preventing food waste. No more throwing away what was once perfectly good food but now is expired. There’s no need to keep piling more food in front of what you already have packed in your freezer and pantry. Use what you have, then buy new.

PRO-TIP: Start fresh by rearranging your cabinets and pantry and place the items that are going to expire first right in the front. Because if you don’t see them, you will surely forget about them until it’s too late.

6 Avoid Over-Stocking

This step is related to #5. There’s a fine line between being smart and stocking up on items when they’re dirt cheap and over-buying and setting yourself up for food waste later on. Be smart about what you choose to stockpile. Make sure you will in fact use it. You should not be stockpiling up on items that are on a regular sale. The same type of items tend to repeatedly go on sale. Save stockpiling for when you come across an insane blowout or clearance sale that likely won’t come around again. And I cannot stress enough… if you’re not going to use it, without a shadow of a doubt, don’t buy it! It doesn’t save you money if you don’t use it.

PRO-TIP: If you’re going to buy in bulk, buy items that will last a long time. Stores will often put food items on clearance that are going to expire soon. Always check expiration dates and avoid buying items in bulk that will expire soon.

7 Make Money On Stuff You’re Already Buying!

Take advantage of the online coupon apps out there! If you don’t want to be bothered with Sunday papers and cutting coupons, this is the way to go! There are many coupon apps out there, but I’m only going to be talking about the ones I use regularly. I won’t vouch for anything I don’t use and love.

IBOTTA

My absolute favorite grocery coupon app is Ibotta! You simply click what store you shopped at, click the products you bought, and Ibotta will deposit money back into your account. For most stores, you’ll have to upload your receipt which is super easy and takes mere seconds. But you can link some of your store rewards cards (such as Rite Aid, CVS, or your local grocery mart) and you won’t even have to upload a receipt! As long as you use your reward card at checkout, Ibotta will automatically know what you bought. When you cash out, you can choose to be paid via PayPal, Venmo, or you can choose gift cards to your favorite stores instead. The app is free and easy to use. I have made almost $250 by just buying products I would’ve bought anyway. Since 2012, Ibotta has given its app users over $500,000,000. Like holy crap! Total no brainer here!

To receive a $10 Welcome Bonus, sign up with this link. You will receive your $10 bonus when you redeem your first product. The bonus amount can change over time so act quickly while it’s still $10!

CHECKOUT 51

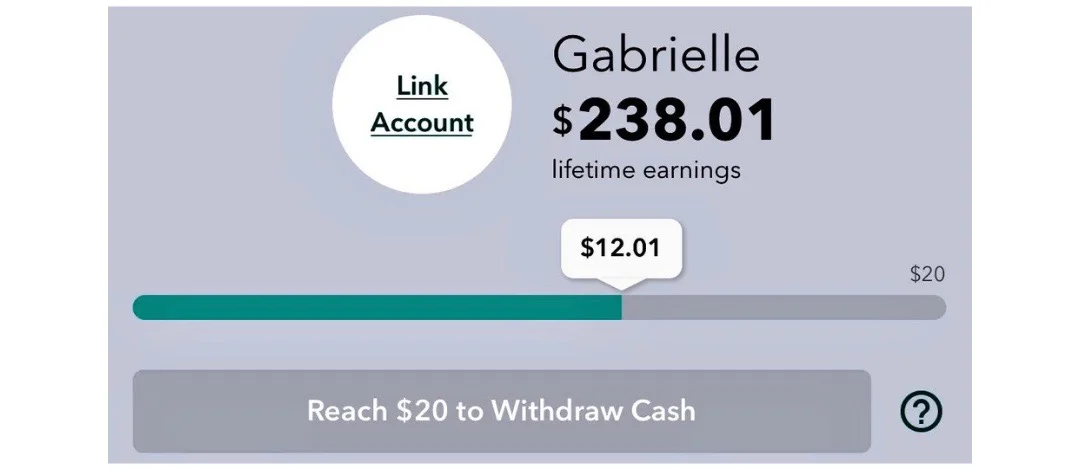

I recently started using the grocery app Checkout 51. This app works the same way as Ibotta except you won’t be able to link rewards cards. You will have to upload a receipt for every offer redemption. But it is so simple. Totally worth the few seconds it takes to do. I have only been using this app for a few weeks, but have already racked up over $9 dollars! You can cash out as soon as you earn $20 (just like with Ibotta). When you cash out, Checkout 51 will send you a check in the mail.

To receive a $5 Welcome Bonus, sign up with this link. You will receive a $2 bonus after you upload your first receipt and $1 each for uploading your next 3 receipts (within 30 days of signing up). The bonus amount can change over time so act quickly while it’s still $5!

SWAGBUCKS

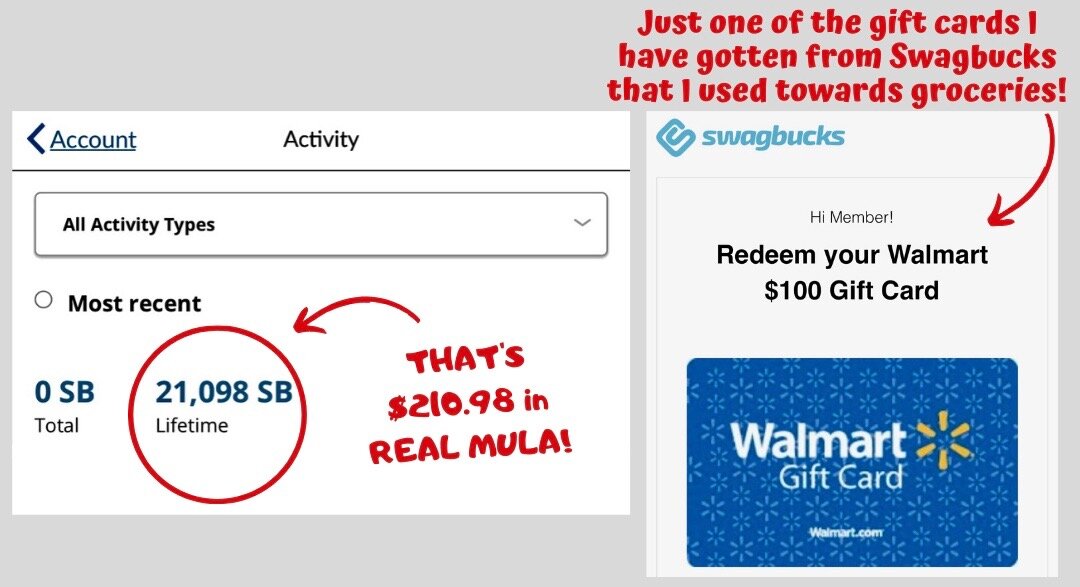

I’m not a huge fan of clipping traditional coupons, but I do use them occasionally. I used to be a much bigger fan before the stores started getting real weird about redeeming them and the Sunday paper inserts dwindled to a few pages. If you’re a diehard couponer, you know what I’m talking about. Clipping coupons isn’t what it used to be. However, I did recently join Swagbucks and they not only offer printable coupons, but you can earn extra money if you use them! Pretty cool, huh? For each coupon you use in a store, you will get 25 SB’s (Swagbucks) deposited into your account (25 SB’s = 25¢). So that’s an extra 25¢ per coupon in addition to whatever the coupons are worth! That adds up!

Swagbucks actually offers many more ways to earn money other than couponing. You can earn money by watching tv, using their search engine, filling out surveys, playing games, and even shopping (just like with Ebates). I shop through Swagbucks all the time, because I can get a good bit of money back; however, don’t waste your time on the surveys and tv watching. It’s definitely not worth the time. But the shopping works just like ebates (see below) and it’s great! You can choose how you want to cash out. You can either have Swagbucks give you Paypal cash or you can choose a gift card. I’ve only been a member for a little over 6 months and I have already received over $200.00 in gift cards! I get mostly Walmart gift cards and then buy groceries with them. I took a screenshot of my lifetime earnings with Swagbucks (I joined about 6 months ago).

Swagbucks is different from the above mentioned apps in that you can cash out as soon as you earn even a few dollars. There are gift cards for $3 and $5 dollars.

To receive a $3 Welcome Bonus, sign up with this link. You will receive a $3 bonus (300 SB’s) after you earn your first 300 SB’s (within 30 days of signing up). The bonus amount can change over time so act quickly while it’s still $3!

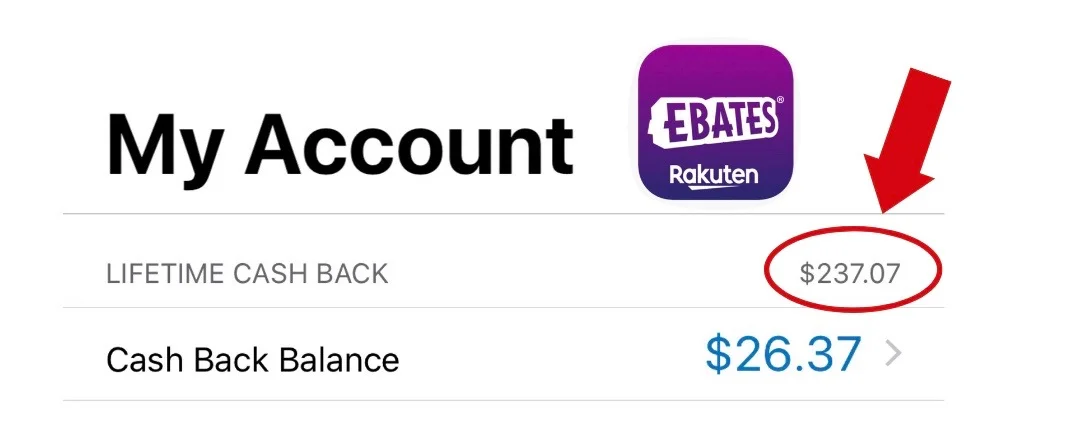

EBATES (RAKUTEN)

Ebates (now called Rakuten) is not a grocery app like ibotta, but it is an awesome money saving app… and my ultimate favorite money saving app! It seriously kicks ass and couldn’t be any easier to use. If you do any bit of shopping online at all and you don’t have an Ebates account already, you need to absolutely sign up!

To receive a $10 Welcome Bonus, sign up with this link. You will receive a $10 bonus after you make $25 in purchases that earn Cash Back (within 90 days of signing up). The bonus amount can change over time so act quickly while it’s still $10!

PRO-TIP: You can stack the offers on multiple money saving apps. For example, both Ibotta and Saving Star could be offering cash back on the same item. You can redeem both offers with one receipt. This happens often. Many times more than one app will feature the same products. On several occasions I have ended up getting a product for free when a particular item goes on sale, is offered on 2 or more of my grocery apps, and then I can also use a traditional clipped coupon in-store. This is why it’s important to take time each week and sit down with your flyers and check your app offers before you go to the store.

PRO-TIP: For all non-grocery apps like Ebates and Swagbucks Shopping, redeem your rewards for gift cards at places you can buy groceries! I usually get Walmart gift cards.

8. Local Grocery Store Rewards

If your local grocery store has a rewards card, make sure you sign up for it. Nowadays many local stores also have digital coupons that you can download right onto your rewards card. So you don’t have to cut out coupons, you simply purchase the items and when the card is scanned at checkout, it automatically applies the coupons. One of my local grocery stores, Giant Eagle, has something called fuel perks where your grocery purchases earn you free gas. I don’t shop at Giant Eagle for groceries because it’s more expensive there but anytime we know we are going to make purchases at other stores (or even restaurants), we buy gift cards there and earn fuel perks. By doing this my husband and I both get a free tank of gas 1-2 times each month. It takes over $90 in gas to fill up my husband’s full size SUV alone (he uses premium gas) and about $30 or so for my small SUV, so even if we only get one tank each in a month’s time, that’s saving at least $130/month! Some month’s it’s double that (and triple that around the holidays because I’m buying a boatload of gift cards not only for our own spending, but as gifts too). Definitely utilize any rewards available to you!

PRO-TIP: Make sure your spouse or partner has his/her own rewards card to keep in their wallet (but linked to the same account as you). Another important tip: Instruct them NOT to redeem any rewards! The cashier usually always asks if you want to redeem and redeeming at the wrong time can waste a lot of money depending on the circumstances. Make sure your significant other knows that YOU and you only are in charge of redeeming the rewards.

9 Meal Prep Within 1-2 Days of Buying Your Groceries

The sooner the better. Meal prepping saves you from wasting money. We all have had our moments when we had to pitch produce in the trash on garbage night because we never did anything with it. Food waste is a huge problem. How many times have you thrown away food and felt horrible about it? I bet a lot. As soon as you get home from the store, wash, dry, and cut any fruits and veggies. This will not only save you time later when it’s time to use them in your recipes, but if they’re serving as snacks, then they’ll be readily available and not passed over for something easier (and unhealthier) to grab. If you have meats that won’t be used until late in the week or possibly not used at all this week, put them in the freezer to keep them from going bad or getting lost in the back of your fridge and not discovered until they’re expired.

PRO-TIP: Make sure your fridge is cleaned out and organized before you leave for the grocery store. In addition, make sure your kitchen is tidy and your sink is empty. This will make meal prepping less daunting when you get home from shopping. If you have an hour’s worth of work to do in the kitchen to clear a work space before you can even start meal prepping, you’ll skip it altogether.

10 Repurpose Leftovers

This is a genius way to make your food go further and save money each and every week! This works especially well for families who aren’t big fans of leftovers. How many times are you cleaning out your fridge the night before garbage pickup and find yourself throwing away a ton of leftovers? It’s so wasteful! Use up every bit of food by repurposing your dinners. For instance, this past Monday we had chicken tacos for dinner. On Wednesday, I took the leftover chicken and made chicken and rice soup for dinner. I already had celery and baby carrots in the fridge, which we had for snacks this past week. I also already had wild rice in my pantry. So without buying anything, I was able to make a second dinner from the leftover chicken. And even if you still had to buy a few ingredients, you wouldn’t have to buy meat, which is the most expensive ingredient. There are hundreds of ways to repurpose your leftover food, but here are a few general ideas:

You will find a super easy and delicious Slow Cooker Bone Broth Recipe HERE. Use bones that you’d normally just chuck in the trash and turn them into gut-healing broth that you can easily freeze and use for future meals!

PRO-TIP: Save your bones from all of your dinners and store in freezer safe gallon- sized baggies in your freezer. Once you collect enough bones to fill up your slow cooker, then you know it’s time to whip up another batch of bone broth!

11 Start Implementing A Leftover Night

If your family doesn’t have a problem with eating leftovers, simply dedicate a night later in the week as Leftover Night. This way you don’t even need to repurpose them. All you need to do is warm up all of the leftovers and have each family member pick what they want. This can be a last minute theme night. If you find it to be already Wednesday and your fridge is brimming with leftovers, cross off the planned dinner for that night and heat up leftovers instead. Not wasting leftovers and reusing them for second dinners will not only save you a ton of money over time, but it will also save you time and let’s face it… often our time is worth even more than money.

PRO-TIP: If you’re expecting some resistance from your family over leftover night, offer a simple dessert like frozen yogurt sundaes, fruit salad with whipped cream, or make any pudding or jello that might be in your pantry. I try to make desserts out of ingredients I already have. I usually always keep vanilla froyo in the freezer, so I’ll often scoop some over warm cinnamon and stevia baked apples for dessert. Or I’ll melt down some leftover chocolate chips in my pantry and make chocolate covered strawberries or pineapple. We don’t normally eat dessert, so tempting my family with it usually makes it easy for them to accept yet another leftover night. Hehe.

12 Cook and Bake From Scratch

We live in a fast paced world and opting for convenience is the norm these days. But if we take a page out of our grandma’s dinner playbook, we can learn a lot… and save a lot of money. Yes, cooking and baking takes more time than hitting up a drive-thru or popping frozen dinners in the microwave but reclaiming control over not only our spending, but our nutrition as well is more important than avoiding some kitchen time. You will pay top dollar for convenient foods and they won’t be as healthy. When we cook and bake from scratch, we save our families from ingesting unhealthy and toxic preservatives, fillers, and dyes that prepared foods are loaded with.

The only exception I make to this rule regularly are the $5 Walmart and Sam’s Club rotisserie chickens. Because buying, preparing, seasoning, roasting, and basting a small chicken will cost me way more than 5 dollars in time and money. It’s a no-brainer and makes for a super easy dinner option. Plus I repurpose any leftovers and make chicken salad for lunch sandwiches for the next few days. Win-win, my friends.

PRO-TIP: You can double recipes, especially if you find a great sale on ingredients, and then freeze the extra for future dinners on busy nights. I always do this with lasagna. I always make a second lasagna and then put it in the freezer. It keeps up to two months and when we have a super busy night or I just don’t feel like cooking, I whip it out of the freezer and BAM there it is. Soups, stews, chilis, and casseroles freeze well too.

13 Pack Your Lunch

This is such a simple money-saving option yet so many people fail to do this! Pack your lunch, bitches! You will end up spending a small fortune on takeout for lunch. Go ahead, add it up. You’ll wanna cry. I know it’s tempting when everyone is ordering out at work, but it’s killing your budget and I bet you’re ordering shit food to boot. So save some money and your waistline and pack your lunch at home.

PRO-TIP: You can implement #10 above and repurpose leftover dinners for your lunch. Especially if your workplace has a microwave. Pack yourself some leftover dinner from the night before and zap that shiz in the microwave and BAM, you’re saving money by not ordering out, you’re preventing food waste (and saving money) by not throwing out leftovers on garbage night, and you’re eating healthier since you made the food yourself so no preservatives, dyes, or filler ingredients. It’s a win-fest, folks.

14 Buy a Drip Coffee Maker

Forget the Keurig machines. Yes I know, they’re nifty and on trend right now (25% of American homes own a single cup coffee maker). But did you ever add up how much you spend on those k-cups? It’s ridiculous! And another thing… did you know that k-cups are quickly becoming a huge danger to our environment? As of right now, the amount of k-cups in landfills could wrap around the planet more than 10 times!**

And how about how much you spend on Starby’s or Dunkin’ each week? When I added up how much I was spending on my Starbucks habit, I nearly fell over… and I definitely did not tell my husband (shhh). I guess I tried not to think about how much I was spending every time I steered my car into the drive-thru. Getting my fix 4-5 times a week, at five bucks a pop, was running me $80-$100/month! And that’s just strictly for the coffee… not adding in the food I’d sometimes order as well. I decided to pick up a good ol’ Black & Decker coffee machine for the cost of only six coffees! I have been buying a huge tub of coffee that makes 400 cups for under $13! That’s comes out to just about 3¢ per cup of coffee. WHAT?! Yup, you read that right. I’d say 3¢ per cup vs. $5.00 per cup is a pretty damn good savings!

PRO-TIP: If you like iced coffee, you can pre-make a pitcher and keep it in your fridge. Just fill a cup with ice and pour.

15 Buy a Filtered Water Pitcher

Stop buying case after case of bottled water. Invest in a good water pitcher and stop wasting your money on bottled water. The average case of bottled water costs $5.00. At 21¢ a bottle, at first it doesn’t seem that expensive. But if you’re drinking the recommended amount of water (eight 8 oz glasses), you’ll need to drink four water bottles (16.9 oz each) a day which comes out to $1.68/day, $50.40/month, and $604.80/year. Keep in mind that is just for one person. In my house, there’s four of us so that comes out to about $2400/year that I was spending on water. That’s a lot… especially since I already pay for the water that comes out of my damn tap! So I decided to buy a water pitcher that purifies the water I already pay for! You could also opt for a purifying faucet filter so that the water that comes straight from your tap is already purified. Stop buying water when you already pay to have it!

And just to add to the appeal of water pitchers/filters, let me give you a terrifying fact about water bottle consumption. Globally, we buy ONE MILLION PLASTIC BOTTLES PER MINUTE**. Per minute!! To add to that horrifying news, 91% of all plastic is not recycled.

PRO-TIP: If you spend a lot of time outside of your home and don’t have access to your water pitcher, you can use a water bottle that has its very own filter. This way you can simply use tap water no matter where you are… and save the earth at the same time. These individual filter bottles also make great gifts for kids. They come in a bunch of different fun colors!

16 Garden By Seed

Give some thought about growing your most often bought fruits and veggies by seed. You don’t have to have a full out garden and if you don’t have a yard, you can even use pots on a patio or porch. Herbs are a great option too. You can even skip the yards and patios for herbs and grow them on your window sills! Everybody has a window sill. In my home, I’m in charge of growing the herbs. Anything else I seem to kill swiftly. My husband on the other hand is a master gardener. I call him the plant whisperer. He grows just about every veggie you can think of and our summers and early falls are filled with delicious home grown produce… all for the cost of seeds, which is near nothing!

Next year I want to take it one step farther and learn how to can. I’ve wanted to learn for so long and never got around to it. Next year I plan on canning a shit-ton of tomatoes to use for sauce, stews, and chilis throughout the winter months.

PRO-TIP: Start a little garden club with a few friends. You can each pick just one or two things to grow and then share when harvest time comes. This is a fun solution and you all can save some money at the same time. There are lots of fruits and veggies that are super easy to grow, so even with no growing experience you can become a master gardener. The following are said to be the easiest to grow: lettuce, tomatoes, green beans, yellow squash, spinach, peppers, cucumbers, and root vegetables such as radishes and carrots.

17 Shop For Groceries Online

Shopping for groceries online can not only save you some money, but also save you mucho time, which can be worth even more than money. Many local grocery stores as well as Walmart and Target now offer delivery. They also have an option to order your groceries online and pick them up curbside. If you have a hard time sticking to your grocery list and find yourself chucking extra stuff in your cart as you browse the aisles, this may be a great option for you. If your store charges a small delivery or pick-up fee (most don’t though), it may be worth it if otherwise you’d be spending double or triple the fee amount on extra items that aren’t on your list.

You can also find some great deals and prices online at Prime Pantry, Prime Fresh, Thrive Market, and Instacart. And remember, anytime you order anything or anywhere online, check and see if there are Ebate/Rakuten discounts you can use to add to your savings.

With Instacart, you get unlimited FREE deliveries for all orders over $35 AND you can order from multiple stores in one order for no extra fee! Like seriously? Screw carting through the aisles and waiting in checkout lines!

To receive a $10 Instacart Welcome Bonus, sign up with this link. You will receive a $10 discount towards your first online order. Order must be $35 (before taxes and service charge). The bonus amount can change over time so act quickly while it’s still $10!

Ways To Save Money On Food At the Store

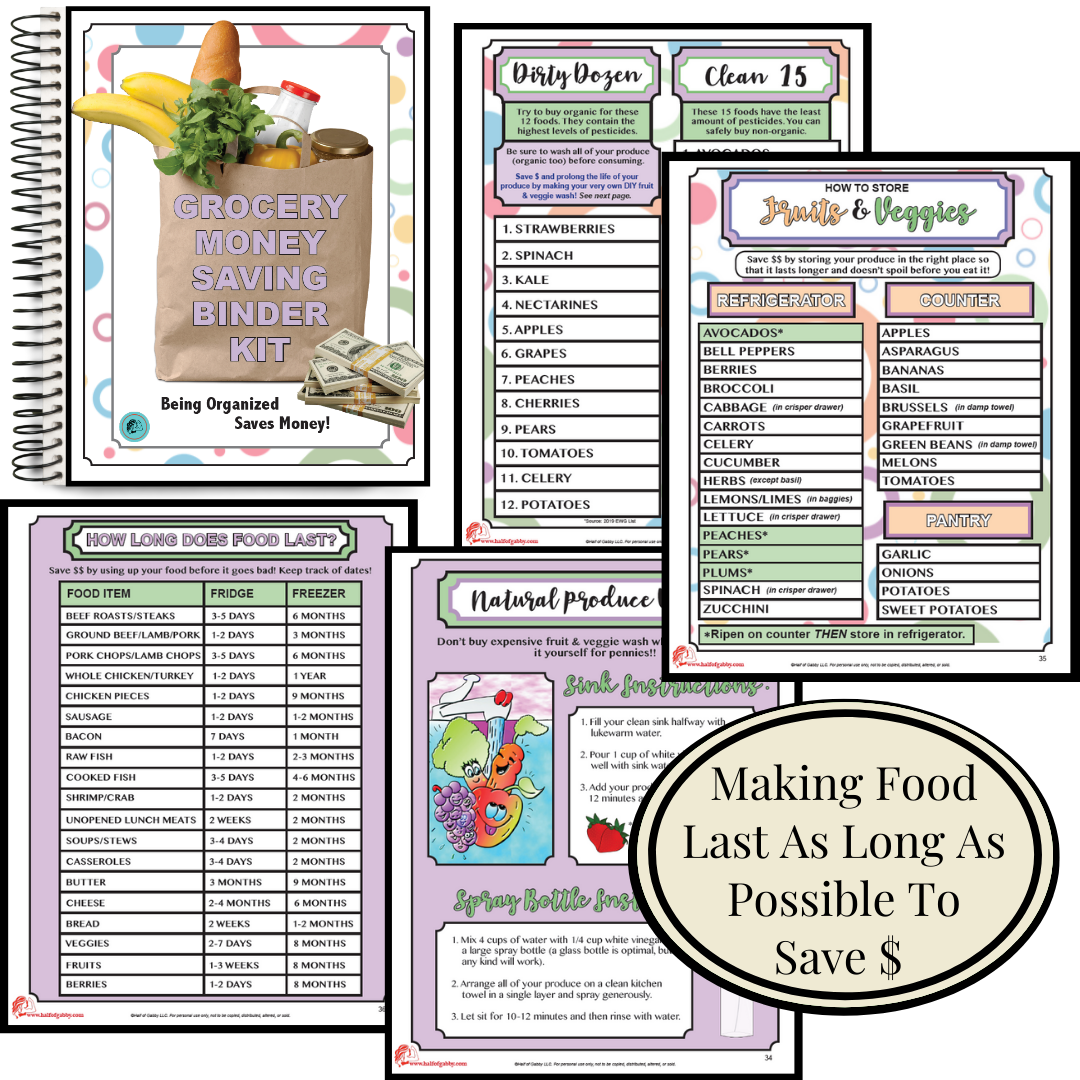

18 Only Buy Organic For the Dirty Dozen

Let’s be honest, if money wasn’t an issue, yes buying everything organic would be best for our health. But for most people, money is in fact a concern. We have to make choices based on what’s best for us overall. The EWG (Environmental Working Group) puts out a Dirty Dozen list each year. The Dirty Dozen list names the produce that contains the most pesticides and toxins. In order to make the healthiest and most economical choice, if it’s on the Dirty Dozen list then buy organic. If it’s not on the list, save some money and buy the regular produce.

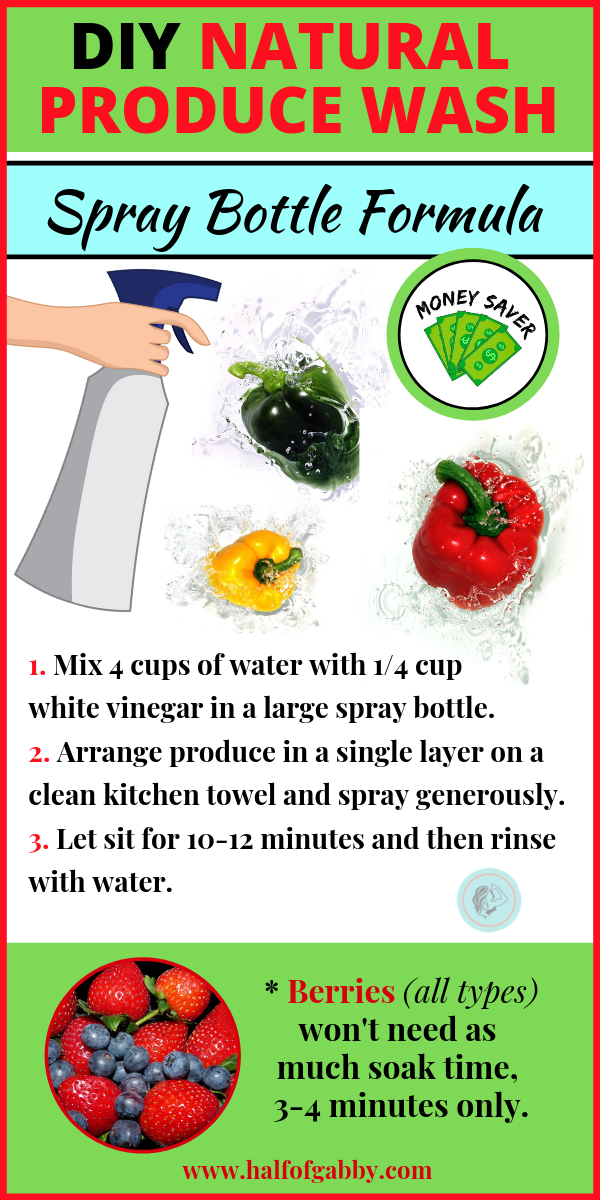

PRO-TIP: Make your own produce wash and inexpensively clean your produce. Below you can find two easy recipes to make your own fruit and veggie cleaner. Pin the images to your Pinterest account so that you always have them! Just tap image in top left corner to pin to your Pinterest account!

Check out my most popular Health & Fitness Pins Here

19 Buy Generic (Store) Brands

I know we all get used to certain brands. Believe me, I did too. But it’s time to branch out and try new things. You will be shocked at how much cheaper the store brand items are and 90% of the time they taste the same. Now, there will be those few you just can’t go without, but try out the store brands first.

PRO-TIP: When shopping, always look at the top and bottom of the shelves. Stores strategically stock the more expensive name brands at eye level. They bank on the fact that you won’t look up or down where the cheaper items are.

PRO-TIP: Some stores offer money-back guarantees on their store brand items, so make sure you investigate a little at your local stores. One of my local grocery stores, Giant Eagle, offers a double your money back guarantee if you try out one of their store brand items and don’t like it. I mean, there’s absolutely no reason to not at least give it a try, right? Right!

20 Check the Price-Per-Ounce

Sometimes the cheaper item is not actually the best buy. Most items have several different sizes available. Instead of just looking at the total price, look at the price-per-ounce. Almost all stores will list the price-per-ounce on the shelf label. If not, whip your phone calculator out.

21 Buy Less Expensive Meats

We often pick the meats that are already prepped to cook, meats that are already trimmed and de-boned. These meats are more expensive because they’re more convenient. You can save money by purchasing the less expensive meats just by putting in a little more effort at home by trimming the skin and de-boning the meats yourself. Purchase chicken thighs instead of boneless skinless chicken breasts, bone-in pork chops and other meats instead of boneless, and tougher cuts of red meat instead of the more premium meats.

PRO-TIP: You can make tougher (less expensive) meats tender and juicy by marinating them or by using a slow cooker.

PRO-TIP: Don’t forget to check for marked-down meat. Often the butcher will discount meats that are expiring soon or meats that are overstocked.

22 Buy Frozen Fruits & Veggies

Obviously in a perfect world we would buy fresh produce all the time, but sometimes it can get pricy. Most people think frozen produce is not as nutritious as fresh and to a very small degree this is true; however, the process of freezing naturally preserves the fruits and veggies and no artificial preservatives are used. The fruits and veggies are frozen immediately after picking and the vitamins and minerals are locked in. In fact, fresh produce will actually lose its nutritional value if it sits on the store shelves too long. It can be many days after the crops are picked that you finally get them home whereas frozen produce is flash-frozen to ensure flavor and nutrition is naturally preserved.

PRO-TIP: Frozen veggies regularly go on sale at most grocery stores, often for as cheap as $1.00 each. Stock up on sales. You can even find Great Value (Walmart store brand) frozen veggies at Walmart for just 88¢ at regular price.

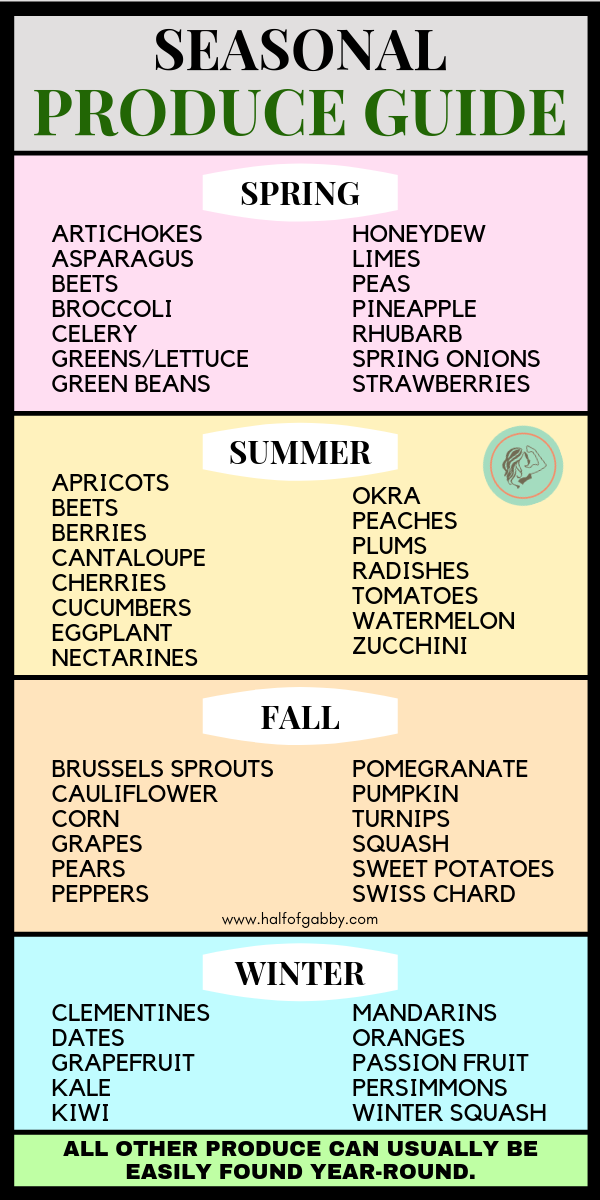

23 Shop By Season

Fruits and veggies that are out of season are always more expensive. Stick with buying in-season produce for better prices. They’re cheaper, more fresh, and of a higher quality.

PRO-TIP: Be aware of what is in season. Below is a handy seasonal list. Pin it for future reference.

24 Buy Whole Produce

You will pay more money for produce that is already pre-cut. It can be very tempting to buy already diced onions or celery, ready-to-eat mango or watermelon slices, or even spiralized veggies but it’ll cost you a pretty penny. Stick with whole produce and save yourself some serious money.

PRO-TIP: If you happen to live near an Aldi, shop there for your produce. The prices cannot be beat and the produce is always super fresh (at least all the Aldis near me!). Not only is the produce cheaper, but you’ll find many different items at great prices as well as many organic options.

25 Buy Spices At The Dollar Store

Spices at local grocery stores are outrageously priced. You will find a pretty decent selection of spices at the dollar store (Dollar Tree is the chain near me). Aldi is another great place to purchase spices for cheap.

PRO-TIP: Another great option when buying spices is to visit your local ethnic stores. Also, in most local grocery marts, there is an ethnic aisle. Most people don’t know that grocery stores will often stock the ethnic aisle with spices from ethnic brands and they are MUCH cheaper than the spices just a few aisles over in the spice aisle. Check out your local grocery store’s ethnic section. You may find a jackpot of inexpensive spices and other items.

26 Don’t Buy Toiletries At Your Local Grocery Store

You will usually pay much more for toiletries at your local marts and pharmacies than nearly everywhere else. Toiletries are usually the cheapest at Walmart and Target. Unless your local grocery store or pharmacy (CVS, Rite Aid, Walgreens) is having a crazy sale, you will most likely pay a lot more for toiletries there. Sometimes it’s worth the extra trip to a different store.

PRO-TIP: If you come across a great sale on toiletries, you may want to consider buying in bulk and stocking up. Unlike food items, most toiletries like toilet paper and soap don’t have an expiration date.

27 Get Rain Checks!

Most people never do this! If a store is having an awesome sale, it’s not uncommon for those sale items to sell out. Most stores will issue you a rain check for sale items. Simply go to the store’s customer service desk and tell them which item you’d like a rain check for. Once the store stocks up again, you’ll be able to get that fabulous sale price.

PRO-TIP: Make sure you have the store associate write down ALL the details about the sale. For instance if the sale is a BOGO sale, make sure the current price is written down. By the time you use your rain check, the regular price may have gone up.

PRO-TIP: Always keep track of the rain check’s expiration date! It’s a good idea to highlight it and keep it in the front of your grocery/coupon binder if you have one. If you don’t have one, keep it in with your cash in your wallet so you always see it and are reminded about it.

28 Only Shop Once Per Week

Avoid hitting the store several times per week. The more times you step foot in there, the more times you’ll be tempted to buy things you don’t really need. This will murder your budget. Shopping only once per week is made easy by planning your meals ahead of time. I know some people who shop only once per month! It works great for them; however, I haven’t been able to make that work for me. My brain can’t think and plan a month ahead of time, lol.

29 Watch The Register At Checkout!

Make sure you’re items are ringing up right! I can’t tell you how many times I have caught my items ringing up wrong. Save yourself an ass ache by nipping it in the bud right there at the checkout. Last month I made the mistake of talking to the bagger instead of watching the register and when I got home I realized they overcharged me by $16.00! Raviolis were on a crazy sale, buy 1 get 2 free, so I bought six bags. They charged me full price for all six ($24.00) when I was supposed to only be charged $8.00. I had to get in my car and go back to the damn store. Total pain in the ass.

PRO-TIP: Even if you think you’ve watched the register closely at checkout, do not leave the store parking lot before checking your receipt. Sometimes you’ll see the price ring up right, but fail to realize an item was scanned twice by mistake. Always check before you go home!

30 Shop Alone

Leave the kids and spouse at home! A surefire way to buy way more than you intended is to have want-y people with you. Most people say their kids are the worst to have with them but for me, it’s my husband. Good Lord that man wants something in every aisle. I make a point of not bringing him with me. It’s a lot more difficult convincing a grown man he doesn’t need Klondikes and ice cream Snicker bars than a child who is easily distracted. At least in my world anyway.

31 Don’t Shop Hungry

This is a no-brainer, but I still have to mention it. You will almost always buy more if you’re hungry! And it’s usually not healthy food! It’s so much easier to stick to your shopping list if you don’t have food on the brain.

PRO-TIP: If you do in fact find yourself at the store hungry like a wolf, there’s no shame in ripping into something that you planned on buying anyway and grazing while you shop. There have been many times that I ripped open a protein bar or snacked on some nuts while I shopped. Anything to tamp down my hunger before I passed the damn cookie aisle, lol.

So there you have it… 31 Ways To Save Money On Groceries. Whew, that was quite a long list! If you only get around to implementing a few of these bad boys, you’ll still save a lot of money. So look through the list a second time and pick some ways that you think will be the easiest to start with and stick with. You can add more ways as you go. Make sure to pin this article or copy and save the URL so you can always refer back to all the tips and tricks to slash your food bills!

HAPPY MONEY SAVING, MY FRIENDS!

~~~

** Fact source: https://www.theatlantic.com/technology/archive/2015/03/the-abominable-k-cup-coffee-pod-environment-problem/386501/

**Fact source: https://www.forbes.com/sites/trevornace/2017/07/26/million-plastic-bottles-minute-91-not-recycled/#10946db5292c

*The information on this site is not intended or implied to be a substitute for professional medical advice, diagnosis or treatment. All content in this article is for general information purposes only. I am not a doctor, nor am I a dietitian. Talk to your physician before making any changes in your diet or exercise regimen. The information found in this article is from various sources which include, but are not limited to, the sites listed above. I encourage you to do your own research and talk with your physician before making any changes in diet or exercise. What has worked for me may not work for you. This information in this article or on this website should never replace or serve as medical advice.

NEVER DISREGARD PROFESSIONAL MEDICAL ADVICE OR DELAY SEEKING MEDICAL TREATMENT BECAUSE OF SOMETHING YOU HAVE READ ON OR HAVE ACCESSED THROUGH THIS WEB SITE.

*Affiliate Disclaimer: As an Amazon Associate, I earn from qualifying purchases. The Federal Trade Commission (FTC) requires all affiliates to put a disclaimer on their website/blog. I will be providing links just as I've always done but now will receive a very small commission, at no cost to you, if you purchase an item through the affiliate link that I provide. An affiliate link is simply a link that brings you to a place where you can buy that product. I will not earn a commission by you simply clicking on the link, you must actually purchase the item(s) within 24 hours of putting it in your Amazon cart. Prices are exactly the same for you if you purchase through an affiliate link on Half of Gabby. You will NOT pay more by clicking through the link. My promise to you is that I will never recommend a product that I don’t fully 100% believe in and/or use myself and recommend to close friends and family.